Investing in ETFs and why Irish-domiciled ETF is better for US Non-Resident Alien

Before one invest in ETFs, it would be good to understand some of the issues affecting a US non-resident alien.

Taxes on Dividends

As a US non resident alien, it is better to invest in ETFs that are domiciled in Ireland, as taxes of 15% (compared to 30% for US listed ETFs) apply to the dividends u get from investing in Irish-domiciled ETFs.

US Estate Tax

The US imposes a 40% estate tax rate on US assets above a $60,000 exemption threshold on assets of the deceased non-residents. It is not advisable to invest directly on US listed ETFs or stocks, especially if the invested amount snowballs to a large amount like 1 million or 0.5 million. Imagine the amount of taxes to be paid to the US after one’s death.

On the other hand, if one is to invest in Irish-domiciled ETFs, you would not be subjected to the US estate tax. Ireland also does not impose estate tax on non-residents.

Liquidity

US listed ETFs tend to have much higher trading volume, compared to Irish-domiciled ETFs. So it is better to look at the average daily trading volume of the UCITS ETFs before u buy them.

Buy those UCITS ETFs with high trading volume.

Bid/Ask Spread

US listed ETFs tend to have a narrower bid/ask spread, as the bid/ask spread is dependent on the liquidity of the ETF. The more liquid the ETF, the smaller the spread.Go for those UCITS Irish-domiciled ETFs with narrow spread.

Expense Ratio

Expense ratio is the amount companies charge investors to manage the ETF. US listed ETFs tend to have a lower expense ratio compared to Irish-domiciled ETFs. In general, it is better to go for the Irish-domiciled ETFs with lower expense ratio.

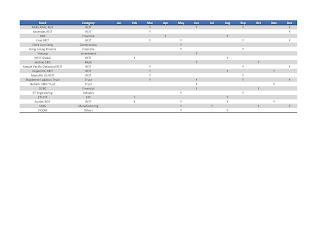

UCTIS Distributing ETFs (USD) for reference

I've listed some UCITS Distributing ETFs by Vanguard and Blackrock. Some of the ETFs are relatively new and the performance data can only be provided for the past 5 years.

Here are some links that you may find useful.

1) Boglehead - US Non-Resident Alien

2) UCITS ETF listing

3) justETF screener

Disclaimer: Please note that the information provided are intended for education purposes, and do not constitute financial or investment advice. You should conduct your own due diligence prior to investing in ETFs.

Taxes on Dividends

As a US non resident alien, it is better to invest in ETFs that are domiciled in Ireland, as taxes of 15% (compared to 30% for US listed ETFs) apply to the dividends u get from investing in Irish-domiciled ETFs.

US Estate Tax

The US imposes a 40% estate tax rate on US assets above a $60,000 exemption threshold on assets of the deceased non-residents. It is not advisable to invest directly on US listed ETFs or stocks, especially if the invested amount snowballs to a large amount like 1 million or 0.5 million. Imagine the amount of taxes to be paid to the US after one’s death.

On the other hand, if one is to invest in Irish-domiciled ETFs, you would not be subjected to the US estate tax. Ireland also does not impose estate tax on non-residents.

Liquidity

US listed ETFs tend to have much higher trading volume, compared to Irish-domiciled ETFs. So it is better to look at the average daily trading volume of the UCITS ETFs before u buy them.

Buy those UCITS ETFs with high trading volume.

Bid/Ask Spread

US listed ETFs tend to have a narrower bid/ask spread, as the bid/ask spread is dependent on the liquidity of the ETF. The more liquid the ETF, the smaller the spread.Go for those UCITS Irish-domiciled ETFs with narrow spread.

Expense Ratio

Expense ratio is the amount companies charge investors to manage the ETF. US listed ETFs tend to have a lower expense ratio compared to Irish-domiciled ETFs. In general, it is better to go for the Irish-domiciled ETFs with lower expense ratio.

UCTIS Distributing ETFs (USD) for reference

I've listed some UCITS Distributing ETFs by Vanguard and Blackrock. Some of the ETFs are relatively new and the performance data can only be provided for the past 5 years.

Here are some links that you may find useful.

1) Boglehead - US Non-Resident Alien

2) UCITS ETF listing

3) justETF screener

Disclaimer: Please note that the information provided are intended for education purposes, and do not constitute financial or investment advice. You should conduct your own due diligence prior to investing in ETFs.

Comments

Post a Comment